Introduction

Running a booth for a weekend can feel simple. You pack your best sellers and a friendly smile. Then sales tax shows up. This guide delivers essential sales tax tips for pop up shops so you can sell with confidence and sleep well after the event. We wrote it for makers, retailers, food vendors, and ecommerce brands that test new markets with short term pop ups. You will learn what to register, when to collect, and how to file without guesswork.

If you need a single takeaway, pin this one. Essential sales tax tips for pop up shops begin with permits, rates, and records. Handle those three and the rest falls into place. We will show you how to set them up for events, fairs, festivals, markets, and trade shows. The same steps help temporary vendors inside retailers or shared spaces.

This is a practical playbook. It has plain language and real world steps. It also covers hard choices and tradeoffs you will face at the booth. You can use essential sales tax tips for pop up shops today even if your next event starts soon.

Who this guide is for

You sell direct at events for a few days at a time. You run an ecommerce store and add a seasonal pop up to boost reach. You are a food truck at a city festival. You are a maker with a table inside a shop. You want essential sales tax tips for pop up shops and for temporary vendors who move often. You want answers that match the way small businesses work. You value clarity, speed, and compliance.

Why sales tax becomes tricky at short term events

Sales tax rules were built for fixed storefronts. Pop ups move. That creates small but important traps. Rates change across city lines. Permits can be event specific. Inventory moves fast. Staffers improvise discounts. Network access drops. Then you must file soon after. Essential sales tax tips for pop up shops tackle these realities head on so you do not learn painful lessons during an audit.

The basics you must know before your first booth

Nexus for pop up shops and temporary vendors

Nexus means a connection to a state that creates an obligation to collect sales tax. Pop up activity often creates physical presence nexus the moment you sell at a location. Economic presence may already exist if your ecommerce sales into the state exceed a threshold. Check both. Essential sales tax tips for pop up shops always start with a nexus check.

Physical presence and economic presence

Physical presence is simple. You show up in person to sell. That usually triggers collection. Economic presence comes from remote sales that pass state thresholds for revenue or order count. Some states only count revenue. Some include both. When either exists you must register, collect, and remit. Tie your plan to both types so you do not miss an obligation.

Temporary seller permits and event registrations

Many states issue temporary seller permits for short term sellers. Some events require each vendor to provide a permit number to the organizer. Others let the organizer collect and remit on behalf of vendors. Read event instructions. Essential sales tax tips for pop up shops include asking the organizer early about tax logistics. If they do not have an answer, go straight to the state revenue agency for guidance.

City county and special district rules

Local taxes sit on top of state tax. Cities, counties, and special districts can add their own rates. Some require separate local registrations. The name of the permit can vary by jurisdiction. Confirm whether your state account covers local collection or if you need city level steps. A quick call to the city hall can save a filing headache.

Marketplace facilitator rules at events

If you sell through a marketplace that processes the payment and lists the sale under their name, they may collect and remit for you. That depends on the marketplace model. Some platforms collect tax for shipped orders but not for in person event sales. Others collect in both cases. Essential sales tax tips for pop up shops include reading platform tax articles and matching your point of sale setup to their rules so you do not charge tax twice.

Essential sales tax tips for pop up shops you can use today

Tip 1: Get the right permits early

Register before you swipe a card. That simple step prevents penalties and blocked event access. Start with a state sales tax permit or a temporary seller permit if the state offers one. Add any required city registration. Ask the event organizer whether they need your permit number for their vendor list. Essential sales tax tips for pop up shops work best when permits are locked in a week before day one.

State and local timing

Some states issue a number within minutes. Others take a few days. City accounts can take longer. Build a short timeline. Put the application step first on your event prep checklist. If you already have a state account, verify that it is active and that the address and contact data are current.

Tip 2: Confirm taxability of what you sell

Not every product is taxable in every state. Clothing can be taxable in one state and exempt in another. Food for home consumption can be exempt or taxed at a reduced rate. Digital goods are a growing category. Services can surprise you. Essential sales tax tips for pop up shops call for a product by product review before the event. Mark each item in your point of sale as taxable or exempt per state rules.

Common categories and surprise exemptions

Clothing, household goods, art, and accessories are usually taxable. Grocery style food may be exempt. Medical items can be exempt with conditions. Educational printed materials can have special treatment. Some states exempt nonprofit sales with proof. Document the rule you rely on. Keep that note in your event binder so staff can answer questions with confidence.

Food beverage and prepared items

Prepared food is often taxable at the full combined rate. That includes food trucks and pop up cafes. Unprepared food may be exempt or taxed at a reduced state rate with local tax still due. Drinks can have their own rules. Read your state guidance for prepared meals and beverages. Set up separate products and tax categories in your point of sale to prevent mistakes during a rush.

Tip 3: Charge the right rate at the event location

Most states use destination based rates for in person sales. That means the rate at the place of the sale. Find the full combined rate for the booth address including city, county, and special districts. Essential sales tax tips for pop up shops include testing your rate in your point of sale the day before the event. Run a one dollar test and see the tax line. If it does not match the city website, fix it before you open.

Destination based rates and special events

Some cities create special event locations with unique local codes. Sports facilities and convention centers can have special district add ons. If you move across the street you may be in a different code. Enter the exact address, not just the zip code, when you set the rate. A precise address avoids over collection and refunds later.

Tip 4: Configure your point of sale for clean tax

A good point of sale reduces risk. Use a system that lets you set tax by location. Map each item to the right tax category. Lock the tax field so staff cannot change it by accident. Essential sales tax tips for pop up shops also include test transactions. Run cash and card tests. Print and email receipts. Check that the tax line shows correctly.

Offline mode cash sales and receipts

Events often have poor signal. Enable offline mode for card readers if your provider supports it. Record cash sales inside the point of sale rather than a separate cash box tally. Email receipts when possible so you have a backup to paper rolls. Store Z reports and end of day summaries in a shared folder.

Tip 5: Keep ironclad records for a short run

Good records beat memory. Create a simple event binder. Include permits, rate confirmations, and a copy of your inventory list. Add a daily close checklist. Essential sales tax tips for pop up shops focus on repeatable steps. Count cash. Close the batch. Export a sales summary. Snap photos of the cash drawer count sheet and upload them to your drive.

Z reports end of day counts and inventory

Run a Z report or the end of day report after the last receipt each day. Note starting cash and ending cash. Record inventory movements. If you bundle goods, note the components for later cost and tax analysis. These habits cut audit time and stress.

Tip 6: File and remit on time after the event

Short events still create filing obligations. Some states assign a one time due date. Others put you on a monthly or quarterly cycle. Put the due date on your calendar before the event starts. Essential sales tax tips for pop up shops include a next business day task. Reconcile sales. Prepare the return. Set the payment.

One time filing versus ongoing returns

If you used a temporary seller permit you may file once and close it. If you used a full permit you may need to file zero returns in months with no sales. Know which case applies. Closing an account too early can block refunds. Leaving it open can trigger notices for missing returns. Choose based on your plan for future events in that state.

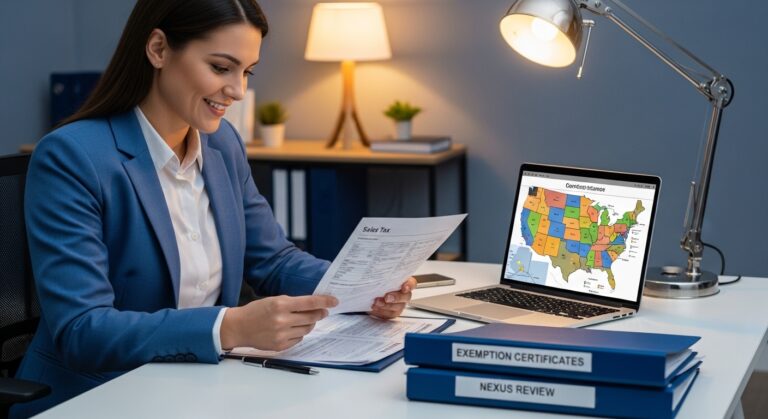

Tip 7: Use resale certificates the right way

Buy inventory tax free when you intend to resell it. Provide a valid resale certificate to suppliers. Use the correct state format. Keep copies on file. Essential sales tax tips for pop up shops include verifying that the certificate matches your legal name and permit number. Misplaced or invalid certificates can lead to assessment during an audit.

Capture verify and store certificates

Scan or photograph each certificate. Save them to a labeled folder by vendor name and year. Some states offer online verification tools. Use them and save a screenshot as proof. Train staff not to accept a certificate from a buyer unless they complete the proper form for that state.

Tip 8: Handle discounts coupons and tax inclusive pricing

Decide if you will show tax as a separate line or include it in the price. Tax inclusive pricing can speed lines but it complicates tax reporting. Separate line pricing is clearer and easier to reconcile. For coupons and discounts, understand whether tax applies before or after the discount based on state rules. Essential sales tax tips for pop up shops encourage a written policy. Put that policy in the binder so every cashier follows the same process.

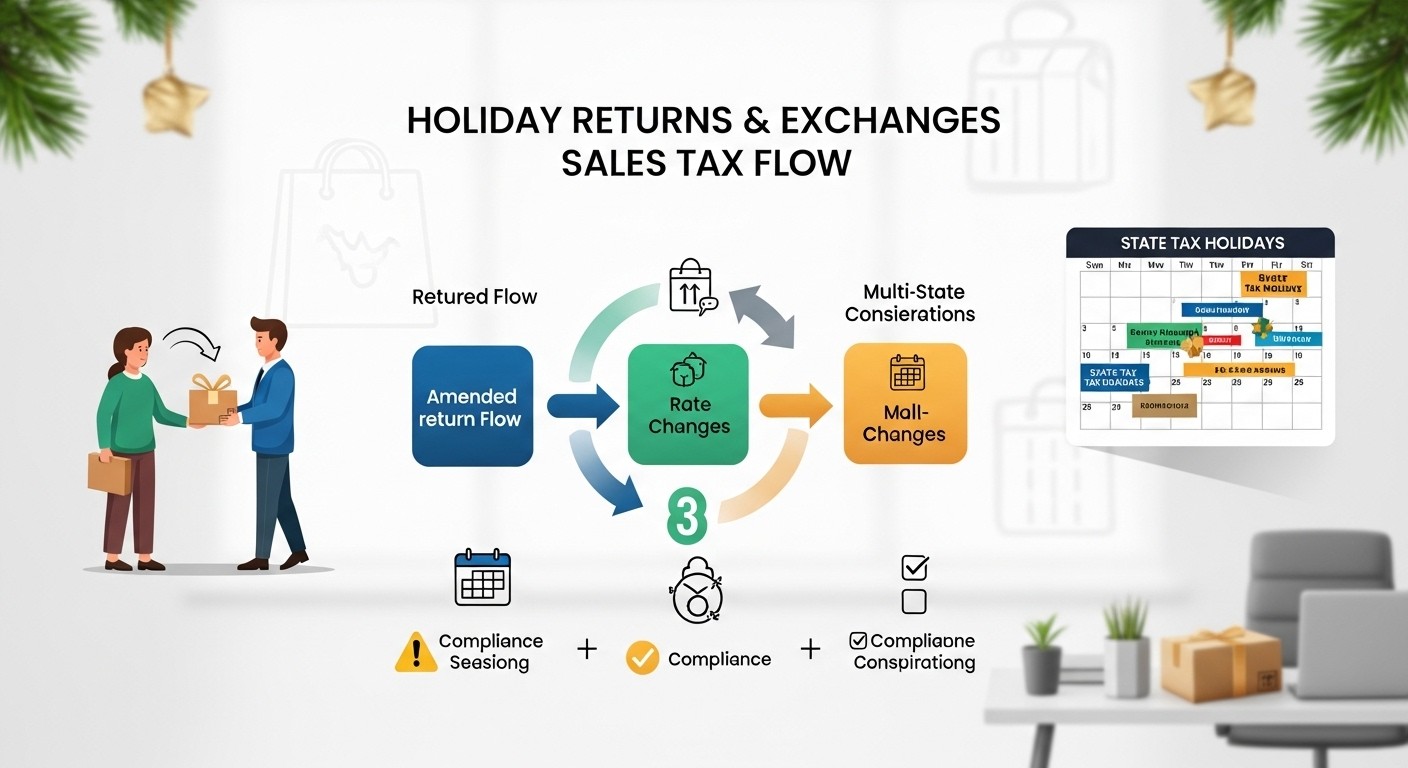

Tip 9: Manage refunds exchanges and voids

Events move fast and mistakes happen. Build a simple refund rule. Always reference the original receipt. If you gave a full refund, return the tax as well. If you exchange an item with a different tax status, collect or refund the difference. Record the reason code for every void. This protects you when you reconcile totals to deposits and inventory counts.

Tip 10: Plan around sales tax holidays and charity events

Some states run sales tax holidays for school supplies, disaster preparedness, or energy saving items. If your event overlaps you may need to treat eligible items as exempt. Charity events may have special rules. Essential sales tax tips for pop up shops include a quick check for holiday dates and for nonprofit documentation. Make a one page cheat sheet for your staff.

State level watchouts you should know

California temporary seller permits and local add ons

California is one of the toughest states for temporary vendors. Even if you’re selling at a weekend market or a one-day festival, the California Department of Tax and Fee Administration (CDTFA) requires you to hold a seller’s permit. If you already have a permanent permit, you must report all sales from the event under it. If not, you can apply for a temporary seller’s permit at no cost. What often trips up vendors is California’s layer of city, county, and district taxes. These local add-ons can vary from one block to the next. For example, a Los Angeles street fair may have a different rate than a venue just one mile away. Always confirm the exact address of your booth to ensure you charge the correct combined rate.

Texas temporary vendors city county school rules

Texas does not require a special temporary permit if you already have a sales tax permit. However, if you’re a one-time vendor with no ongoing presence in Texas, you must apply for a temporary sales tax permit before the event. The bigger issue in Texas is how the tax breaks down. Texas sales tax is made up of the state’s 6.25 percent plus up to 2 percent local tax, which includes city, county, transit, and even special purpose districts. Imagine working a county fair in Harris County — you may owe multiple local rates at once. Without careful attention, it’s easy to under-collect or over-collect.

New York certificate of authority and events

In New York, no one is allowed to make taxable sales without first obtaining a Certificate of Authority from the Department of Taxation and Finance. This rule applies even if you’re only selling for a single day at a pop-up in Brooklyn. Unlike California, New York does not issue temporary permits, so you must obtain a full certificate that allows you to collect and remit sales tax. What’s more, if you attend multiple events, the state expects you to file returns even for periods when you have no sales. Ignoring this requirement can lead to penalties and cancellation of your certificate.

Florida event sales and holiday periods

Florida is known for its frequent sales tax holidays, particularly around back-to-school season and hurricane preparedness. If you’re selling clothing, school supplies, or storm gear during one of these holidays, certain items may be temporarily exempt. This can be confusing because only specific price ranges and categories qualify. For example, a shirt under $100 may be tax-free, while one at $105 is taxable. Vendors at Florida pop-ups must be extra careful to apply the exemption correctly, or risk both overcharging customers and failing to remit properly.

Washington special event reporting and local codes

Washington requires event organizers to provide the Department of Revenue with a list of all vendors. In some cases, the department will reach out directly to vendors to ensure compliance. Washington also has some of the most complex local codes in the country, with hundreds of location-specific rates. Even small differences in address can mean different tax obligations. If you operate in multiple Washington markets, you’ll want to use a reliable rate lookup system or professional support.

A weekend compliance checklist in plain English

Before heading to your next pop-up, run through this mental checklist.

- Do you have the proper permit or certificate in hand?

- Have you confirmed the taxability of your products, including food or promotional items?

- Is your point-of-sale system configured with the exact event location’s tax rate?

- Have you tested both card and cash transactions?

- Do you have a plan for end-of-day reporting and record keeping?

- Finally, have you scheduled time to file your return promptly after the event? This quick review can save you headaches when the dust settles.

Tools and setups that make pop ups less risky

Point of sale settings and rate tables

A good POS system is your best friend at temporary events. Look for one that allows you to pre-load location-specific rate tables, so you don’t need to calculate on the fly. Many systems also support tax-inclusive pricing, which can simplify checkout in a busy booth. Test your system in offline mode too, since event Wi-Fi is rarely reliable.

Inventory counts and audit trails

Keep tight control of your inventory. Start with a count when you set up, track each sale, and recount when you close. This ensures your reported sales align with your actual product movement. If the state ever questions your sales, having a clear audit trail will work in your favor.

Reconcile marketplace and booth sales

If you sell both online and at a pop-up, reconcile your sales data carefully. Marketplaces may collect and remit tax on your online orders, but not for in-person sales. Blending the two without a system creates gaps that auditors love to find. Separate reporting by channel is the safest route.

Common mistakes and how to avoid them

Many pop-up vendors fall into predictable traps. They assume one permit covers all events, when in fact states like New York require ongoing certificates. They forget to adjust for local add-ons in states like California or Texas. They neglect recordkeeping, thinking a weekend of sales won’t matter, only to get flagged in a future audit. Others mishandle tax holidays, exemptions, or resale certificates, leaving them liable for tax they didn’t plan for. The key to avoiding these mistakes is preparation, documentation, and knowing when to bring in expert help.

When to get professional help

What My Sales Tax Firm does for pop ups and events

At My Sales Tax Firm, we specialize in taking the guesswork out of compliance for pop-up shops and temporary vendors. We help you register for the right permits, confirm rates and product taxability, configure your systems, and file clean returns after the event. Instead of scrambling to interpret complex state and local rules, you can focus on selling with confidence. Whether you’re setting up at a farmers market, craft fair, or national expo, our team ensures your sales tax compliance is handled seamlessly.

Conclusion

Pop-up shops and temporary vendors face unique challenges when it comes to sales tax. A single weekend can create obligations across multiple jurisdictions, each with its own set of rules. By preparing ahead, securing the right permits, charging the correct rates, and keeping clean records, you protect both your business and your peace of mind. Remember that compliance is not just about avoiding penalties — it’s about building trust with your customers and creating a sustainable model for future events.

Need help making sense of your obligations? Talk to our experts at My Sales Tax Firm for a free consultation today.