Introduction

If you run a small business or an e-commerce store in the U.S., you’ve probably already realized sales tax isn’t something you can just “figure out later.”

It’s one of those silent killers. You might think you’ve got it covered—until a notice shows up in your mailbox or inbox. Then suddenly you’re dealing with interest, penalties, and enough stress to ruin your week (or your quarter).

Here’s the scary part: sales tax mistakes small businesses make usually don’t look like mistakes at first. It’s the small things. The rules you didn’t know. The forms you didn’t file. The states you didn’t realize you were on the hook for.

Let’s break down the 5 most common and most expensive sales tax mistakes—and what you can do to dodge them like a pro.

Mistake #1 – Ignoring Nexus Laws

What is Nexus and Why It Matters

“Nexus” is one of those legal buzzwords that most business owners never hear until they’ve already messed it up.

It simply means a “connection” to a state that makes your business responsible for collecting and remitting sales tax there. If you have nexus in a state and you’re not registered or collecting tax—you’re in trouble.

Economic Nexus vs. Physical Nexus

There are two main types:

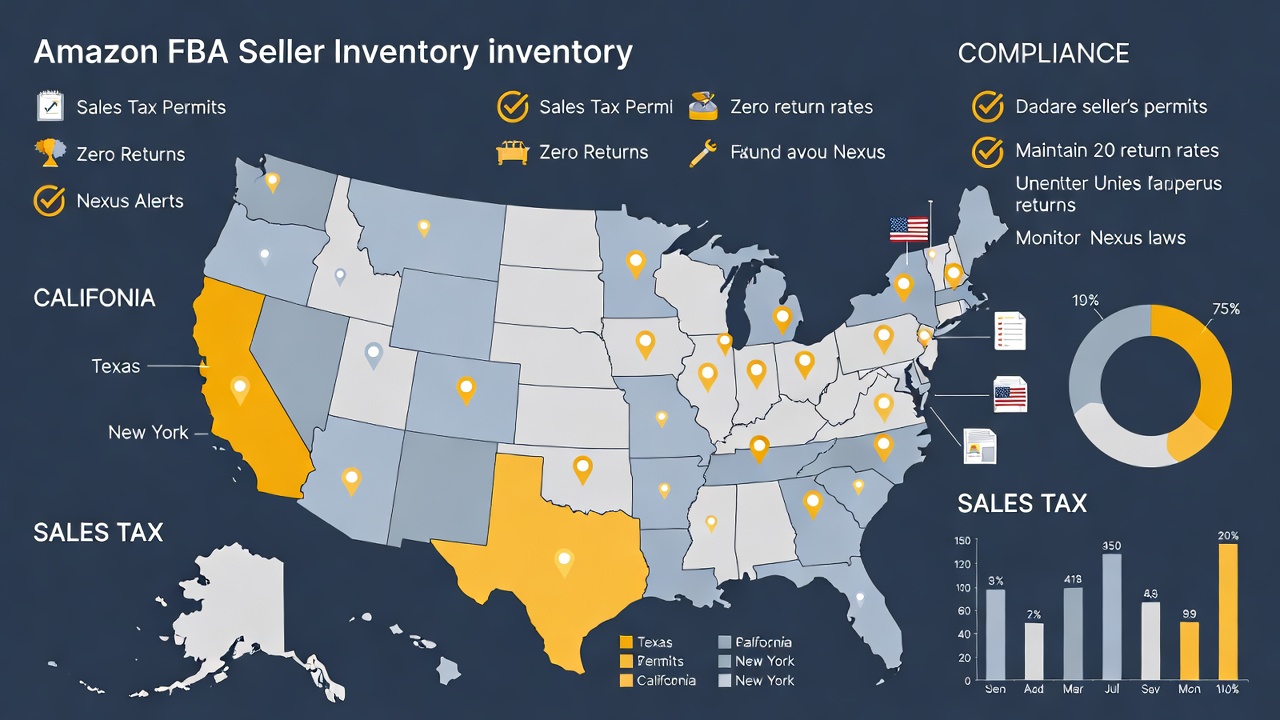

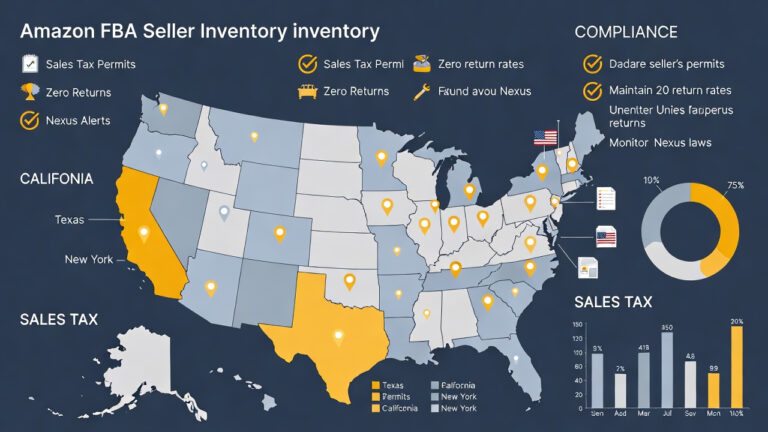

Physical nexus: You have a physical presence—an office, employee, warehouse, or inventory stored in that state.

Economic nexus: You trigger tax obligations based on sales volume or number of transactions, even if you’ve never stepped foot in the state.

A typical example? If you sell over $100,000 or make 200 transactions in a state like Illinois or Georgia, congratulations—you’ve got economic nexus.

State Revenue Departments Are Watching

Here’s the kicker: States are broke. And they’re laser-focused on increasing collections. They’re getting smarter, using software and cross-state data sharing to identify non-compliant businesses.

If you ignore nexus, you might fly under the radar… for a while. But when they catch up? You could owe back taxes for years, plus penalties and interest.

Sales Tax Thresholds Can Be Easy to Cross

You don’t need to be a big business to trip these wires. Even selling through platforms like Amazon, Etsy, or Shopify can create economic nexus in multiple states faster than you’d expect.

And once you cross that threshold, you’re obligated—whether you realize it or not.

Mistake #2 – Failing to Register for Sales Tax Properly

Sales Tax Registration Requirements

Think you can just start charging tax when you want? Nope. Before collecting a single penny, you must register with the appropriate state revenue department and get a valid sales tax permit.

No permit = no legal right to collect tax.

What Happens if You Don’t Register in Time

Here’s what happens when you skip registration:

You collect tax illegally (which can be considered fraud)

You don’t collect tax (and you owe it out-of-pocket)

You file late or not at all (penalties incoming)

All three of these are costly—and unfortunately, sales tax mistakes small businesses make often start right here.

Multi-State Tax Compliance Confusion

Each state has its own process. Different forms. Different deadlines. Some even require local-level registration.

Trying to keep it all straight without help? That’s a full-time job—and a common trap for growing e-commerce businesses.

The Trap of Inaccurate Tax Reporting

Even if you’re registered, your job isn’t done. If your tax reporting doesn’t match your actual sales or collections, you could be flagged for an audit.

And when they start digging, they don’t stop at just one mistake.

Mistake #3 – Collecting Tax Incorrectly

Common Errors in Tax Collection

Collecting tax is more complicated than clicking “enable sales tax” in your shopping cart settings.

Here’s what businesses get wrong:

Charging tax when they shouldn’t

Not charging tax when they should

Using incorrect rates

Applying the wrong rules for product categories

For example, in New York, clothing under $110 is tax-exempt. Charge tax on that, and your customers will be upset. Don’t charge it when required? The state will come knocking.

State Sales Tax Issues Vary Wildly

What’s taxable in one state might not be in another. Services, software, shipping fees—they’re all treated differently depending on where your buyer lives.

You can’t assume what works in Florida will fly in California.

Tax Jurisdictions Are a Maze

Some states have thousands of tax jurisdictions. Colorado is infamous for this. You might have the right base rate but forget the city, county, or special district tax.

That’s how inaccurate tax reporting happens—and how you end up with a giant mess during filing season.

How Automation Tools Can Make It Worse

Many assume sales tax software solves this. But most of these tools rely on data you input. They don’t verify it. They don’t warn you when nexus rules change.

If you pick the wrong settings or miss an update, your automated tax tool might be “automating” mistakes across your entire business.

Mistake #4 – Mismanaging Exemption Certificates

What Counts as a Valid Certificate

If you sell to nonprofits, wholesalers, or resellers, they might be exempt from sales tax. That’s fine—but only if you have a valid exemption certificate on file.

It’s not enough for someone to say, “We’re tax-exempt.” You need the paperwork to prove it.

When Certificates Expire or Are Invalid

Certificates aren’t one-and-done. Some expire. Others are incomplete. Some aren’t valid for the state or product category you’re selling in.

And if you get audited? You have to present a valid certificate for each exempt sale. No certificate = you owe the tax.

Overlooked Tax Obligations from Exempt Sales

Exempt sales can be a trap. Businesses assume they don’t need to collect tax—then forget to track exemptions properly.

It’s one of those overlooked tax obligations that catches people off guard.

Auditors Love Looking for Missing Certificates

You know what’s easy for an auditor to spot? A big line of exempt sales… and zero documentation to back them up.

Missing certificates are a top sales tax audit trigger. Don’t give them an easy win.

Mistake #5 – Filing and Remitting Late

Tax Filing Deadlines by State

Once you’re registered, you need to file—even if you made no sales.

Some states require monthly filings. Others quarterly. Some want you to file annually… until your sales increase, then they demand monthly filings again.

Miss just one? That’s a red flag.

What Tax Remittance Actually Involves

Filing is one thing. But you also have to remit (pay) the tax you collected. And that payment needs to be accurate, on time, and matched to your filings.

Fall behind on this? You’re digging yourself into a very expensive hole.

Costly Sales Tax Penalties

Let’s put it bluntly: penalties add up fast. Some states charge a flat fee. Others tack on a percentage of what you owe. And interest accrues on top of all that.

Miss a few months? You could owe thousands. Easily.

Top Tax Filing Mistakes That Lead to Audits

Here’s what draws attention:

In short, sales tax mistakes small businesses make with filing are easy to avoid—but painful when they aren’t.

Bonus Mistake – Thinking Sales Tax Software Has You Covered

Automation Is Not a Set-It-and-Forget-It

Sales tax software is a great tool—but not a magic bullet. It doesn’t read your mind, and it certainly doesn’t keep up with every new rule or exemption.

You still need to configure it, check it regularly, and correct errors manually.

Sales Tax Automation Still Requires Oversight

Too many businesses assume automation means hands-off. That’s a mistake.

Software won’t know if you have nexus in a new state. It won’t tell you if a customer exemption certificate expired. It won’t file a late return for you.

That’s your job—or your accountant’s.

Software Can Miss Audit Triggers

We’ve seen it happen: a business relies on automation, gets audited, and discovers the software used the wrong rate in 12 states… for 18 months.

Sales tax automation helps — but only if you treat it as a helper, not a replacement.

How to Avoid Sales Tax Errors

Sales Tax Compliance Tips for Small Businesses

Monitor nexus regularly in all states you sell to

Register for permits before collecting tax

Stay on top of rate changes and product taxability

Keep exemption certificates up to date and on file

File and remit on time, every time

Get Expert Help Before It’s Too Late

Sales tax is not DIY-friendly. It’s technical, it changes constantly, and every mistake comes with a price.

Work with a team that specializes in small business tax, sales tax registration, nexus laws, and multi-state tax compliance.

You’ll save money, avoid penalties, and sleep better at night.

Conclusion

Sales tax is tricky. But avoiding it won’t make it go away.

The sales tax mistakes small businesses make often start small — but end up costing thousands in penalties, back taxes, and legal fees. Whether it’s ignoring nexus, collecting tax incorrectly, or trusting software too much, every misstep is a liability waiting to happen.

So here’s your next move: Don’t guess. Don’t hope it works out. Talk to a sales tax expert today – before the IRS or your state auditor does.