If you sell on Amazon using FBA, you probably think Amazon handles all your sales tax. Right? Not exactly. Amazon may remit tax as a marketplace facilitator, but your Amazon sales tax liability extends far beyond what Amazon collects.

You must understand where your business has nexus, how FBA inventory creates physical presence in states you’ve never visited, and why you may be required to file sales tax returns, even when Amazon has already collected tax for buyers. If you miss these obligations, you may face penalties, back taxes, and compliance risk.

Why Sales Tax Nexus Matters for FBA Sellers

Traditional Sales Tax Nexus Explained

Sales tax nexus is a legal connection between your business and a state that triggers tax responsibilities. Historically, this connection was physical — a store, office, or warehouse — but online seller rules have expanded it. Nexus now includes economic thresholds like sales volume or number of transactions in a state.

Amazon FBA Inventory Creates Physical Nexus

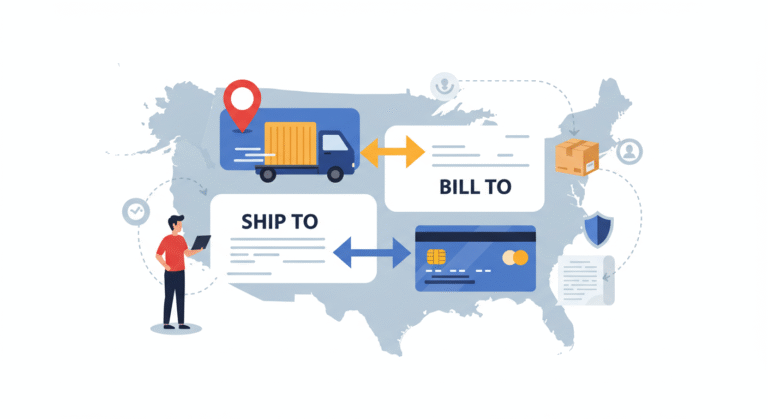

When you send inventory into Amazon’s fulfillment network, you’re not just delivering products to Amazon. You are placing your tangible personal property into warehouses across multiple states. Many states legally interpret that storage as your physical presence — even if Amazon controls the inventory.

Amazon’s logistics algorithms distribute your products automatically, creating inventory in states you didn’t choose or plan for. Each inventory location can establish nexus, and selling through FBA can open a multistate compliance footprint you didn’t even know existed.

Marketplace Facilitator Laws vs. Underlying Obligations

What Amazon Actually Remits

In nearly every U.S. state with sales tax, marketplace facilitator laws require marketplace platforms like Amazon to calculate, collect, and remit the tax on your behalf when you make sales through the marketplace. This collection obligation is important, but it doesn’t tell the whole story.

Where the Seller Still Holds Responsibility

Marketplace facilitator laws do not eliminate your responsibility to:

Determine where you have nexus.

Register with state tax authorities.

File required sales tax returns.

You own the legal nexus obligation. Amazon remits tax on the sales but doesn’t relieve you from compliance and filing duties.

Filing Requirements Even When Amazon Collects Tax

What a “Zero Return” Is

A zero return is a state sales tax return you file when you have a sales tax permit in a state but didn’t collect any tax yourself because Amazon already handled collection and remittance under marketplace facilitator rules. This tracks your gross sales to the state.

Why Zero Returns Are Mandatory

Once you have a sales tax permit, most states require periodic returns — often monthly or quarterly — even if all the tax has already been collected by Amazon. Failing to file these returns can lead to:

In many states, you must report your gross sales and then deduct the tax Amazon collected. Even if all you report is zeros on tax liability, the filing itself is required.

Practical Compliance Steps for FBA Sellers

Tracking Inventory Locations

Your first compliance step is knowing where your products are stored. Use Amazon Seller Central reports (Inventory Event Detail or Restock reports) to identify which fulfillment centers hold your inventory. Each state identified could be a nexus state.

Registering in Nexus States

Once you confirm nexus (physical or economic), register for a sales tax permit or certificate of authority with that state’s Department of Revenue. Registration ensures legal compliance and allows you to file returns properly.

Filing & Reporting Returns

After registration, follow the state’s filing frequency. Even when Amazon collects the tax, file your sales tax returns and report taxable and non-taxable deductions as required. Use your sales data from Amazon to support accuracy.

Tradeoffs, Challenges & Common Mistakes

FBA sellers face several compliance tradeoffs and risks:

Unplanned nexus footprint: Amazon’s dynamic inventory system can create nexus in many states without warning.

Different state rules: Some states treat inventory as nexus, others do not. Compliance can vary by jurisdiction.

Zero return missteps: Filing too late or failing to register can trigger penalties and back filings.

Tool dependence: Without accurate reports and tracking tools, you may overlook nexus states.

Being proactive with tracking, documentation, and filings helps you avoid surprises.

Conclusion

Amazon sales tax liability for FBA sellers is more complex than “Amazon collects the tax.” Your inventory footprint creates nexus, registration is often required, and states expect regular filings — even zero returns. Understanding these obligations protects you from penalties and compliance risk. Contact My Sales Tax Firm for a free consultation to assess your nexus footprint and streamline your state filings.