Running an ecommerce business feels like navigating a minefield sometimes, doesn’t it? Just when you think you’ve got everything figured out, something like ecommerce sales tax liability comes along and threatens to derail your success. That’s exactly what happened to Sarah, whose thriving online fashion boutique faced a shocking $40,000 sales tax liability that could have destroyed her business.

This isn’t just another success story. It’s a real-world example of how the right approach, combined with professional expertise, can turn a potential business disaster into a manageable situation. More importantly, it demonstrates why ecommerce sales tax liability issues require human insight that goes far beyond what any software can provide.

Let’s dive into how we, at MSTF, helped Sarah eliminate her entire ecommerce sales tax liability and what other business owners can learn from her experience.

The Challenge – Understanding Ecommerce Sales Tax Liability in Today’s Complex Landscape

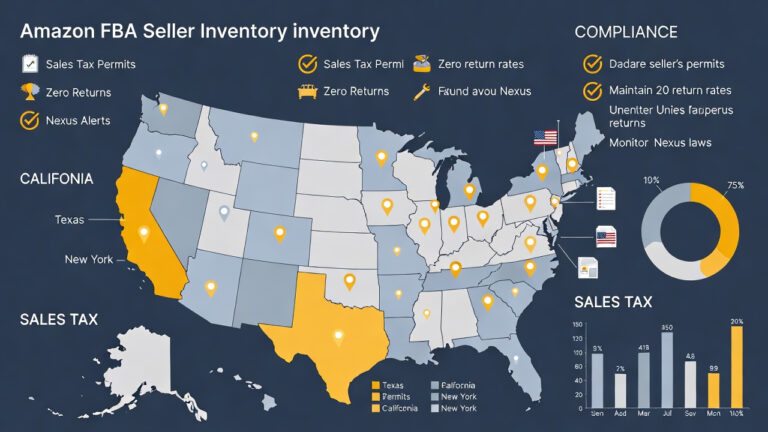

The world of ecommerce taxation changed dramatically after the 2018 Wayfair decision. Suddenly, businesses that had been operating legally for years found themselves facing unexpected ecommerce sales tax liability across multiple states. The complexity multiplied overnight, leaving many business owners scrambling to understand their new obligations.

Meet Sarah’s Online Fashion Boutique

Sarah built her online fashion boutique from the ground up. Starting five years ago from her garage, she’d grown her business to generate over $2 million in annual revenue across 45 states. Her success story was everything you’d expect from the American dream – until the day she received that dreaded notice from the California tax authority.

The letter claimed she owed $28,000 in unpaid sales tax, plus penalties and interest that brought her total ecommerce sales tax liability to nearly $40,000. Sarah was devastated. She’d been using popular ecommerce software that she thought was handling all her tax obligations automatically.

“I trusted the technology completely,” Sarah told us during our first consultation. “I never imagined I could owe this much in taxes when I thought everything was being handled properly.”

The Wake-Up Call – A State Tax Notice

That California notice wasn’t an isolated incident. Within weeks, Sarah received similar notices from Texas, Florida, and New York. Her ecommerce sales tax liability wasn’t just a California problem – it was a multi-state nightmare that threatened to consume her business’s entire cash reserves.

The notices revealed a common pattern among ecommerce businesses. Sarah had triggered economic nexus thresholds in multiple states without realizing it. While her software was collecting tax in some states, it wasn’t configured properly for others, creating gaps in compliance that accumulated over time.

This situation perfectly illustrates why ecommerce sales tax liability issues can’t be solved by technology alone. Each state has unique requirements, thresholds, and filing procedures that require human understanding and interpretation.

Identifying the Root Causes of Sales Tax Liability Issues

When we began analyzing Sarah’s situation, we discovered that her ecommerce sales tax liability stemmed from several interconnected issues that are surprisingly common among online businesses.

Economic Nexus Confusion After Wayfair

The Wayfair decision created economic nexus rules that vary significantly from state to state. While most states adopted the $100,000 or 200 transactions threshold, others like California set their threshold at $500,000, and Texas has different rules entirely.

Sarah’s business had crossed nexus thresholds in twelve states over the past three years, but her ecommerce platform was only collecting tax in five of them. The gap created her ecommerce sales tax liability because she was legally required to collect tax in all twelve states.

Understanding these nuances requires more than just reading state websites. It demands experience with how different states interpret their own rules, knowledge of recent changes, and insight into how various ecommerce platforms handle multi-state compliance.

Overlooked Tax Obligations Across Multiple States

Many ecommerce businesses assume that if they’re collecting sales tax somewhere, they’re probably compliant everywhere. This dangerous assumption led to Sarah’s ecommerce sales tax liability growing for months without her knowledge.

Each state where you have nexus requires separate registration, regular filing, and ongoing compliance monitoring. Some states require monthly filings, others quarterly or annually. Some have specific requirements for product categories, while others offer exemptions that can significantly reduce your tax burden.

Sarah’s fashion boutique sold clothing, which is exempt from sales tax in some states but not others. Her software wasn’t sophisticated enough to handle these exemption nuances, leading to both under-collection and over-collection issues that contributed to her overall ecommerce sales tax liability.

The Technology Gap – When Software Isn’t Enough

Here’s where the human element becomes crucial in addressing ecommerce sales tax liability. Sarah’s ecommerce platform advertised “automated tax compliance,” but automation only works when it’s properly configured and regularly maintained.

Her software hadn’t been updated to reflect recent changes in state tax laws. It wasn’t configured to handle her specific product mix properly. Most importantly, it couldn’t provide the strategic thinking needed to minimize her tax exposure legally.

Technology is a tool, not a solution. Without human oversight, even the best tax software can create compliance gaps that lead to significant ecommerce sales tax liability issues down the road.

Our Strategic Approach to Eliminating Sales Tax Liability

Eliminating Sarah’s $40,000 ecommerce sales tax liability required a comprehensive strategy that combined technical analysis with relationship-building and negotiation skills that only experienced professionals can provide.

Comprehensive Multi-State Analysis

Our first step was conducting a complete audit of Sarah’s sales tax obligations across all 45 states where she had customers. This wasn’t just about identifying where she owed tax – it was about understanding the full scope of her ecommerce sales tax liability and identifying opportunities for relief.

We discovered that Sarah had been collecting tax in three states where she didn’t actually have nexus, meaning she’d been overpaying taxes for months. This over-collection provided leverage in our negotiations with the states where she did owe money.

The analysis revealed that her actual ecommerce sales tax liability was closer to $31,000, not the $40,000 in notices she’d received. Several states had calculated penalties incorrectly, and others had applied interest to periods where Sarah didn’t actually have nexus obligations.

Historical Transaction Review and Documentation

Reducing ecommerce sales tax liability often depends on having proper documentation to support your position with state tax authorities. We spent weeks reviewing Sarah’s historical transactions, identifying patterns, and building a comprehensive record of her business activities.

This documentation proved crucial when we discovered that Sarah’s business qualified for several exemptions she hadn’t been claiming. For example, her sales to other businesses for resale weren’t properly documented, leading to over-assessment of her ecommerce sales tax liability in several states.

The review also revealed that some of her high-volume sales periods had been misreported, leading to nexus determinations in states where she hadn’t actually crossed the threshold. Correcting these errors reduced her overall ecommerce sales tax liability by nearly $8,000.

The Human Element – Why Professional Expertise Made the Difference

Technology can calculate taxes and generate reports, but it can’t negotiate with state tax authorities or provide the strategic thinking needed to minimize ecommerce sales tax liability. That’s where human expertise becomes invaluable.

Navigating Complex State Regulations

Every state has its own interpretation of tax laws, filing requirements, and penalty structures. What works in California won’t necessarily work in Texas, and what’s acceptable in New York might be prohibited in Florida.

Our team’s experience with multiple state tax authorities allowed us to approach Sarah’s ecommerce sales tax liability strategically. We knew which states were typically willing to negotiate penalties, which ones required specific documentation formats, and which ones offered voluntary disclosure programs that could reduce her overall liability.

This knowledge can’t be automated. It comes from years of experience working with state tax authorities and understanding how different states approach ecommerce tax compliance.

Building Relationships with State Tax Authorities

Perhaps the most critical factor in eliminating Sarah’s ecommerce sales tax liability was our ability to build productive relationships with the tax authorities in each state. These aren’t adversarial relationships – they’re professional partnerships focused on achieving compliance while minimizing the burden on business owners.

We worked directly with tax agents in California, Texas, Florida, and New York to explain Sarah’s situation, provide documentation, and negotiate reasonable solutions. In several cases, we were able to eliminate penalties entirely by demonstrating good faith efforts at compliance.

Technology can’t build these relationships. Software can’t explain the nuances of your business situation to a tax agent or negotiate penalty relief based on your specific circumstances.

Implementation and Results – From $40,000 Liability to Zero

The most satisfying part of our work with Sarah was watching her ecommerce sales tax liability disappear through a combination of corrections, negotiations, and strategic compliance planning.

Negotiating Penalty Relief

Our negotiations with state tax authorities resulted in complete elimination of penalties in three states and significant reductions in the others. We demonstrated that Sarah’s non-compliance was unintentional and that she was taking proactive steps to ensure future compliance.

The penalty relief alone reduced her ecommerce sales tax liability by $12,000. This wasn’t just about saving money – it was about preserving her business’s cash flow and allowing her to invest in proper compliance systems going forward.

Establishing Proper Going-Forward Compliance

Eliminating current ecommerce sales tax liability is only half the battle. The other half is ensuring it doesn’t happen again. We worked with Sarah to implement a comprehensive compliance system that combines the best technology with ongoing professional oversight.

Her new system includes quarterly compliance reviews, regular updates to reflect changing state laws, and proactive monitoring of her sales to identify new nexus obligations before they become problems.

Most importantly, Sarah now has access to professional guidance whenever questions arise. Technology will always have limitations, but human expertise can adapt to changing circumstances and provide strategic guidance that prevents future ecommerce sales tax liability issues.

Key Lessons for Ecommerce Business Owners

Sarah’s experience offers valuable insights for other ecommerce business owners who want to avoid their own ecommerce sales tax liability crisis.

Early Detection Saves Money

The longer ecommerce sales tax liability issues go unaddressed, the more expensive they become. Sarah’s $40,000 liability could have been a $5,000 problem if it had been caught earlier.

Regular compliance reviews can identify potential issues before they become major problems. This isn’t something you can set and forget – it requires ongoing attention and professional expertise to do properly.

The Importance of Professional Guidance

Technology is an important tool for managing ecommerce taxes, but it’s not a substitute for professional expertise. The complexity of multi-state tax compliance, the nuances of different state regulations, and the relationship-building required to resolve ecommerce sales tax liability issues all require human insight and experience.

Sarah’s story demonstrates that the cost of professional guidance is minimal compared to the potential cost of getting it wrong. Her $40,000 ecommerce sales tax liability could have been prevented entirely with proper professional oversight from the beginning.

Conclusion

Sarah’s journey from facing a devastating $40,000 ecommerce sales tax liability to achieving complete compliance demonstrates the power of combining professional expertise with strategic thinking. While technology plays an important role in tax compliance, it can’t replace the human insight needed to navigate complex state regulations, build relationships with tax authorities, and develop strategies that minimize both current liability and future risk.

The key takeaways from Sarah’s experience are clear. Ecommerce sales tax liability issues are increasingly common in our post-Wayfair world, but they’re also entirely preventable with the right approach. Technology alone isn’t enough – you need experienced professionals who understand the nuances of multi-state tax compliance and can provide the strategic guidance necessary to protect your business.

Don’t wait until you receive that first tax notice to address your sales tax obligations. The cost of prevention is always lower than the cost of correction, and the peace of mind that comes with proper compliance is invaluable.

If you’re concerned about your own ecommerce sales tax liability or want to ensure your business is properly protected, My Sales Tax Firm offers free consultations to help you understand your obligations and develop a compliance strategy that works for your business. Our experienced team combines the best technology with human expertise to provide comprehensive solutions that protect your business and support your growth.