Do you sell both products and services to your customers? Then you’re navigating one of the trickiest areas of sales tax compliance. Picture this: you run a software company that sells licenses along with installation services, or maybe you’re a contractor providing materials plus labor. Either way, you’re dealing with what tax professionals call mixed sales tax transactions. And here’s the thing: get it wrong, and you could face audits, penalties, and some serious financial headaches.

Moreover, the stakes have gotten higher since the Supreme Court’s decision in South Dakota v. Wayfair. Today, businesses face economic nexus rules across multiple states, each with different requirements for mixed transactions. So, let’s dive into how you can stay compliant when your business straddles both worlds.

What Makes Mixed Sales Tax So Complex?

Understanding mixed sales tax starts with recognizing why it’s so challenging. When you sell a product, sales tax rules are usually straightforward. When you provide a pure service, most states don’t tax it. But what happens when you bundle them together?

Understanding Bundled Transactions

A bundled transaction occurs when you sell two or more distinct products or services for a single, non-itemized price. Think about it like this: if you’re selling software with training, are you really selling software? Or are you selling education that happens to include software?

Furthermore, bundled transactions come in two main types. First, there are true bundled transactions where all items are either taxable or exempt. Second, there are mixed bundled transactions combining taxable and non-taxable items. The latter creates the real compliance challenges.

Here’s where it gets tricky. In many jurisdictions, if even one item in your bundle is taxable, the entire transaction becomes taxable. That’s right—your non-taxable service might suddenly face taxation simply because you included a taxable product.

The Challenge of Multi-State Operations

Additionally, multi-state operations amplify these challenges exponentially. Each state defines taxability differently. For instance, digital goods face taxation in Washington and Texas but remain exempt in Illinois and Florida. Consequently, what works in one state might create liability in another.

Consider this scenario: you’re based in California but serve clients nationwide. California uses modified origin-based sourcing for in-state sales but destination-based rules apply differently across states. Meanwhile, Ohio applies origin sourcing for tangible property but destination sourcing for services. Confusing? Absolutely.

How the True Object Test Determines Taxability

The true object test serves as the primary tool tax authorities use to determine whether your mixed sales tax transaction is taxable. Think of it as asking: what’s the customer really buying?

What Are Your Customers Really Buying?

This test examines the primary purpose of the transaction. Is the customer’s true intent to acquire tangible goods, or is the tangible item merely incidental to a service? The answer determines everything.

Specifically, the true object test asks several critical questions:

- What motivated the purchase?

- Could the service be provided without the tangible item?

- Is the tangible property essential or merely convenient?

- What did your marketing emphasize?

However, this test is inherently subjective. What seems obvious to you might look different to an auditor. That’s exactly why documentation becomes crucial.

Real-World Examples of the True Object Test

Let me give you a concrete example. Recently, Colorado applied the true object test to an online learning platform. The platform sold subscriptions featuring streaming video lessons and transcripts, plus access to tutors.

The state determined that customers primarily wanted the video content and transcripts (taxable tangible property). Although the platform included tutoring services, these merely supported the main product. Therefore, the entire subscription became taxable.

Conversely, imagine a consulting firm that provides strategic advice and happens to deliver a written report. Here, the true object is the expertise and analysis. The report simply documents the service. In this case, the transaction likely remains non-taxable.

Key Compliance Strategies for Mixed Sales Tax

Now that you understand the complexity, let’s talk solutions. Implementing the right strategies can protect your business from costly mistakes and audits.

Separately State Your Charges

This strategy represents your best defense. Instead of bundling everything into one price, itemize your invoice clearly. Show exactly how much you’re charging for products versus services.

For example:

- Software license: $5,000 (taxable)

- Installation and training: $2,000 (non-taxable service)

- Total: $7,000

By separating charges, you remove ambiguity. Auditors can see exactly what’s taxable and what isn’t. Moreover, this transparency often reduces your overall tax liability while demonstrating good-faith compliance.

Document Everything Thoroughly

Documentation serves as your insurance policy. Maintain detailed records showing:

- Contracts clearly distinguishing products from services

- Invoices with itemized charges

- Internal policies on how you classify offerings

- Marketing materials describing your services

- Cost allocation methods for bundled items

Remember, if you face an audit, you’ll need to prove your classification decisions. Without proper documentation, auditors might reclassify your entire offering as taxable.

Apply the De Minimis Rule

Some states offer relief through the de minimis rule. Generally, if the taxable portion represents 10% or less of the total transaction, the entire sale might be considered non-taxable.

For instance, suppose you charge $10,000 for consulting services and include $800 worth of printed materials. In states with a de minimis rule, this entire transaction might escape taxation since the taxable component falls below the threshold.

However, be careful. Not all states apply this rule, and thresholds vary. Always verify the specific requirements in each jurisdiction where you operate.

State-Specific Rules You Can’t Ignore

Each state brings its own unique requirements to mixed sales tax compliance. Ignoring these differences creates substantial risk.

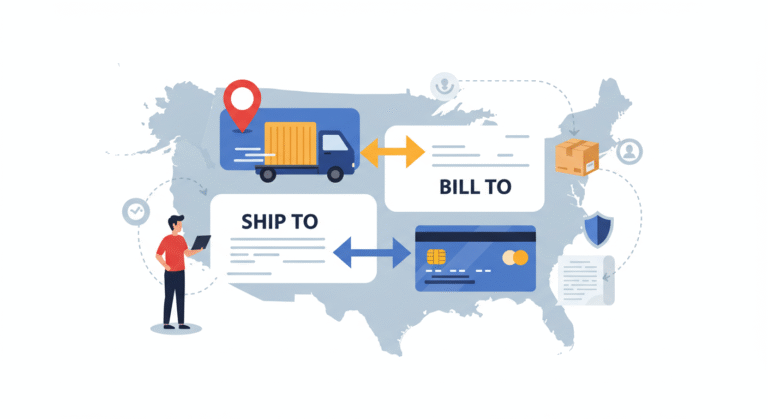

Destination vs. Origin Sourcing

Sourcing rules determine which tax rate applies to your transaction. Most states now use destination-based sourcing, meaning you charge tax based on where your customer receives the product or service.

However, some states like California use modified origin-based sourcing for in-state transactions. Meanwhile, certain states apply different sourcing rules depending on whether you’re selling products or services.

Additionally, local jurisdictions often add their own tax layers. Philadelphia, for example, applies both state and city sales taxes. Consequently, you might collect multiple tax rates on a single transaction.

Digital Goods and Services Variations

Digital products create another layer of complexity in mixed sales tax scenarios. Is your SaaS product a taxable digital good or a non-taxable service? The answer varies dramatically by state.

Some states specifically tax Software as a Service, while others consider it a non-taxable service. Furthermore, states distinguish between canned software (typically taxable) and custom software (often exempt). When you bundle these with professional services, classification becomes even murkier.

Common Mistakes That Trigger Audits

Understanding what catches auditors’ attention helps you avoid their scrutiny. Certain red flags practically guarantee a second look at your mixed sales tax compliance.

Undifferentiated Line Items

Auditors specifically target invoices that lump products and services together. When they see vague descriptions like “Professional Services Package – $10,000,” they assume the worst. Often, they’ll reclassify the entire transaction as taxable.

Instead, be specific. List each component separately with clear descriptions. This transparency demonstrates compliance and makes audits much smoother.

Misclassifying Service Components

Another common mistake involves incorrectly claiming that services are exempt when they actually face taxation in certain states. Remember, some states tax specific services, including data processing, information services, and certain digital offerings.

Additionally, businesses often misapply the true object test. They focus on what they think they’re selling rather than what the customer is actually buying. This misalignment creates exposure during audits.

Why Expert Guidance Matters

Here’s the reality: mixed sales tax compliance isn’t something you can figure out once and forget. Rules change constantly. States expand their tax base. New court rulings shift interpretations of existing laws.

While software helps with calculations, it can’t replace human judgment. Software doesn’t understand the nuances of your specific business model. It can’t apply the true object test to your unique situation. It doesn’t know when state rules conflict or how to document your position for audit defense.

Think of it this way: you wouldn’t trust automated software to make strategic business decisions, right? Similarly, you shouldn’t rely solely on technology for complex mixed sales tax determinations. The stakes are too high, and the rules are too nuanced.

That’s where experienced tax professionals provide real value. They stay current on changing regulations across all fifty states. They understand how different jurisdictions interpret bundled transactions. They can review your specific situation and develop compliant strategies that minimize your tax burden.

Ready to ensure your mixed sales tax compliance is bulletproof? Contact My Sales Tax Firm today for a free consultation. Our team of experts will review your business model, identify potential exposure, and develop a customized compliance strategy that protects your bottom line. Don’t wait until an audit notice arrives; let’s get ahead of potential problems together.