Have you checked where your sales pushed you over nexus thresholds this year? Moreover, December isn’t just about holiday sales anymore. It’s become the most critical month for sales tax compliance planning. With 2026 bringing sweeping changes to nexus rules, exemption requirements, and local tax rates, businesses that wait until January will find themselves scrambling to catch up.

Think of year end compliance as your business’s annual health checkup. Just like you wouldn’t skip your physical exam, you can’t afford to overlook this essential review. The stakes? Penalties, back taxes, and audit headaches that could cost you tens of thousands of dollars. Consequently, this roadmap breaks down exactly what you need to do before the clock strikes midnight on December 31.

Why Year End Compliance Planning Matters More Than Ever

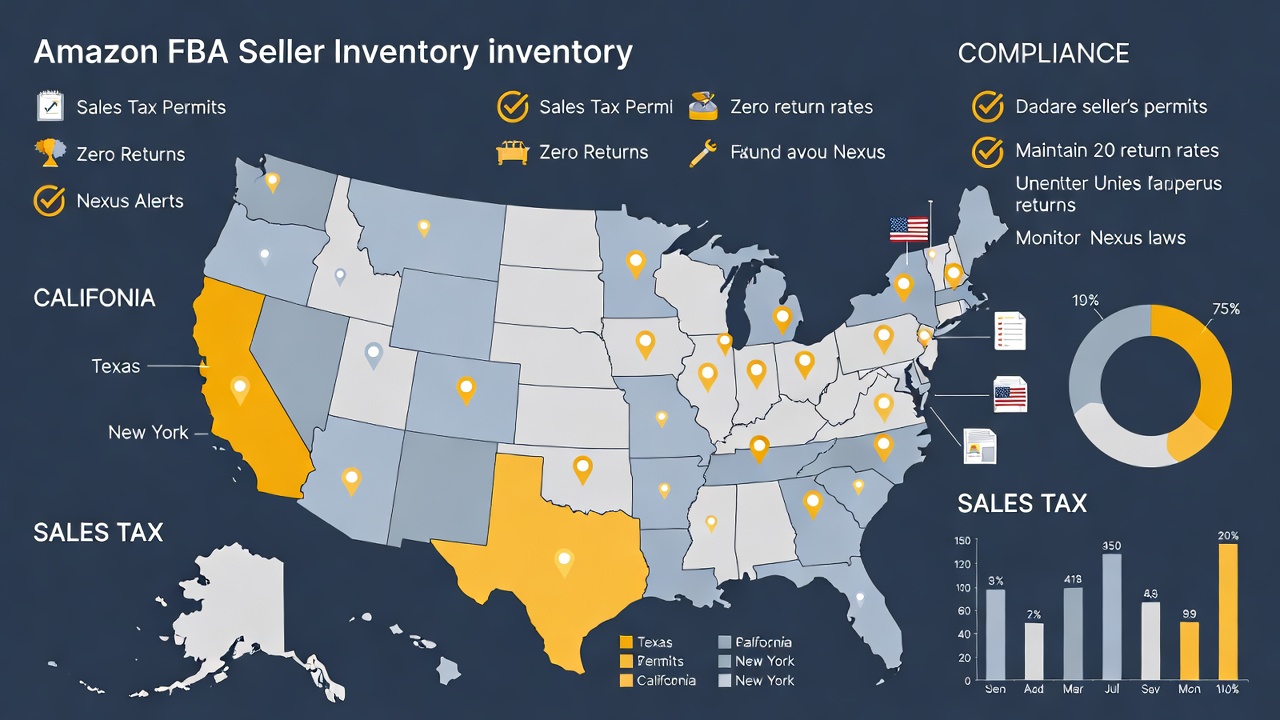

The sales tax world underwent massive shifts in 2025, setting the stage for an even more complex 2026. Over 400 rate changes swept across jurisdictions nationwide. Furthermore, states recalibrated their approaches to economic nexus, product taxability, and filing frequencies. These weren’t minor tweaks; they represent fundamental shifts in how businesses must approach compliance.

What does this mean for you? Every year-end sale could push your business over a new state’s nexus threshold. Additionally, every exempt transaction requires documentation that meets increasingly strict standards. The margin for error has essentially vanished.

Understanding the 2026 Sales Tax Landscape

The 2026 sales tax landscape looks dramatically different than previous years. States eliminated transaction count thresholds, expanded digital goods taxation, and reduced vendor discounts. Illinois dropped its 200-transaction threshold entirely, now requiring registration at $100,000 in sales alone. Meanwhile, Maine expanded taxability to include digital audiovisual and audio services, affecting streaming subscriptions and podcast platforms.

Local jurisdictions added complexity with specialized levies for transportation, public safety, and community improvement projects. Washington reported dozens of new local levies effective January 1, 2026. A single ZIP code can now contain multiple overlapping tax rates, making manual calculations nearly impossible. Therefore, businesses operating across state lines face an increasingly fragmented compliance landscape that demands constant vigilance.

Step 1: Review Your Economic Nexus Obligations

Economic nexus rules determine where you must collect and remit sales tax, regardless of physical presence. Following the landmark South Dakota v. Wayfair decision, every state with sales tax established economic thresholds. However, these thresholds aren’t static; they evolve constantly based on state revenue needs and legislative priorities.

Year-end is the perfect time to review your nexus footprint. Why? Because holiday sales often push businesses over thresholds they’ve been approaching all year. Once you cross that line, you’re obligated to register, collect, and remit sales tax in that state. Missing this obligation exposes you to penalties and back tax assessments.

Transaction Threshold Changes Are Reshaping Nexus Rules

Transaction thresholds are disappearing across America. Utah and Illinois eliminated their transaction counts in 2025, joining a growing list of states simplifying their nexus standards. Only 18 states still use transaction thresholds, and that number will likely drop in 2026.

Why does this matter? Previously, a business making 199 sales worth $500,000 might avoid nexus in states with 200-transaction thresholds. Now, revenue alone determines your obligation. This shift particularly impacts high-ticket sellers with lower transaction volumes. If you sell luxury goods, industrial equipment, or specialized services, you’re more likely to hit revenue thresholds faster.

Additionally, states calculate thresholds differently. Some count all sales, including exempt and wholesale transactions. Others only track retail sales. Understanding these nuances prevents surprises during audits.

Calculating Your Exposure Across States

Start by pulling reports showing sales by state for the past 12 months. Most states use a rolling 12-month lookback period. Compare these figures against each state’s threshold, typically $100,000 in annual sales. However, some states like California use $500,000, while others like Alabama use $250,000.

Don’t forget to include marketplace sales. If you sell through Amazon, eBay, or similar platforms, the marketplace facilitator typically handles collection. Nevertheless, you still need to track these sales for nexus determination purposes. Some states require separate reporting even when marketplace facilitators collect on your behalf.

Watch for approaching thresholds too. If you’re at $85,000 in a state by November, you’ll likely cross into nexus territory before year-end. Proactive registration prevents rushed compliance and potential penalties for late registration.

Step 2: Audit Your Exemption Certificate Management

Exemption certificates allow customers to purchase without paying sales tax under specific conditions. Nonprofits, resellers, and manufacturers commonly use these certificates. However, accepting an invalid certificate transfers tax liability to you, the seller. During audits, missing or incomplete certificates become your responsibility, including penalties and interest.

Think of exemption certificates as insurance policies. You hope you’ll never need to prove their validity, but when audit time comes, they’re your only protection. Unfortunately, many businesses treat certificate collection casually, storing paper forms in filing cabinets or scattered digital folders. This approach inevitably fails when auditors request documentation.

Why Invalid Certificates Cost You Thousands

Invalid certificates represent one of the most expensive compliance mistakes businesses make. Here’s what goes wrong: A customer claims exemption, you accept their certificate without proper review, and you don’t collect sales tax. Months or years later, during an audit, the state examines that certificate and finds it incomplete, expired, or fraudulent.

Suddenly, you owe the uncollected tax plus penalties and interest. On a $10,000 sale at 8% tax rate, that’s $800 in tax, potentially $200 in penalties, and accumulating interest. Multiply this across dozens or hundreds of transactions, and you’re looking at assessments in the tens of thousands.

Common certificate problems include missing signatures, incorrect exemption reasons, expired nonprofit status, or mismatched buyer information. Moreover, each state has unique requirements. Texas requires specific forms like 01-339 for resale, while California accepts resale certificates that remain valid indefinitely unless circumstances change. Keeping track of these state-by-state variations overwhelms businesses operating nationally.

Building a Verification System That Works

Effective certificate management requires systematic processes, not ad-hoc collection. First, collect certificates at the point of sale, before processing tax-exempt transactions. Delayed collection leads to forgotten requests and missing documentation. Second, verify certificate information immediately. Check that all required fields are complete, signatures are present, and exemption reasons align with the purchase.

Third, store certificates digitally in a centralized, searchable system. Paper files fail during audits when you can’t locate specific certificates quickly. Digital storage with proper indexing by customer name, state, and certificate type streamlines audit responses. Fourth, set renewal reminders. While some states don’t require certificate expiration, others do. Florida requires annual renewal, while Texas certificates remain valid unless business information changes.

Finally, conduct annual certificate audits. Review all stored certificates, verify continuing customer eligibility, and request updated certificates when necessary. Nonprofit status can lapse, resale permits expire, and business structures change. Annual reviews catch these issues before audits do. Remember, while technology helps, human oversight remains essential for catching anomalies and unusual situations that automated systems might miss.

Step 3: Update Product Taxability Classifications

Product taxability determines what you charge tax on and what remains exempt. Sounds simple, right? Unfortunately, taxability rules vary wildly by state and change frequently. What’s taxable in Texas might be exempt in Massachusetts. What was exempt last year might be taxable in 2026.

Several major taxability shifts take effect in 2026. Maine now taxes digital audiovisual and audio works, including Netflix, Spotify, and podcast subscriptions. Illinois eliminated its statewide grocery tax but allows local municipalities to impose their own 1% levy. Utah expanded its restaurant food tax to include customized foods from grocery stores and gas stations. These changes require immediate system updates to maintain compliance.

Digital Goods and SaaS Face New Rules

Digital products face increasing taxation nationwide. Streaming services, downloadable software, and SaaS subscriptions once operated in a gray area. No longer. States view these products as revenue opportunities and are rapidly closing exemption loopholes.

If your business sells digital goods or services, review taxability in every state where you have nexus. Subscription models require particular attention. Monthly recurring revenue creates ongoing collection obligations. Missing even one month of tax collection on subscriptions compounds into significant liability over time.

SaaS taxability remains especially complex. Some states tax it as software, others as a service, and some don’t tax it at all. Maryland began taxing many IT services at reduced rates in mid-2025. Pennsylvania has specific rules distinguishing taxable and exempt software services. Understanding these distinctions prevents both over-collection (annoying customers) and under-collection (exposing you to liability).

Grocery and Essential Items See Rate Changes

Essential items experienced significant policy shifts in 2025, with more changes expected in 2026. States facing inflation concerns eliminated or reduced taxes on necessities. Arkansas phased out its statewide food tax entirely, though local jurisdictions can still impose levies. Mississippi reduced grocery tax rates to ease consumer burdens.

However, definitions matter. What counts as “groceries” versus “prepared food” varies by state. Some states exempt basic groceries but tax prepared meals, candy, soft drinks, or dietary supplements. Moreover, the line between grocery stores and restaurants blurs with the rise of meal kits, hot food bars, and prepared salads.

Restaurant operators face their own challenges. Utah’s customized food tax now applies to convenience stores and gas stations preparing food on request. This expansion affects businesses that never previously collected restaurant taxes. If your business model involves any food preparation or customization, review current tax obligations carefully.

Step 4: Prepare for Filing Frequency Changes

Filing frequency determines how often you must submit returns and remit collected tax. New businesses typically file quarterly or annually based on estimated tax liability. As sales volume grows, states require more frequent filing, eventually moving to monthly schedules. This transition isn’t optional; states mandate frequency based on your collection volume.

Why does this matter for year end compliance? Because many businesses cross filing frequency thresholds during holiday sales periods. If your fourth quarter pushed you into a higher revenue bracket, you might receive notices in early 2026 requiring monthly filing. Prepare now rather than scrambling later.

When Monthly Filing Becomes Your New Reality

Monthly filing creates significantly more administrative work than quarterly filing. Instead of four annual returns, you’re managing twelve. Each return requires transaction reconciliation, exemption tracking, and accurate reporting across multiple jurisdictions within the state. The compliance burden multiplies.

Moreover, monthly filing demands tighter cash flow management. Tax collected in January must be remitted by February’s deadline. You can’t hold collected tax for 90 days like quarterly filers. This shorter cycle affects cash flow planning, especially for businesses with seasonal revenue patterns.

States typically notify businesses of frequency changes, but don’t rely on timely notices. Proactively monitor your collection volumes. If you’re approaching monthly filing thresholds in multiple states, plan now for increased administrative requirements. Consider whether your current systems and staffing can handle monthly compliance, or if you need to outsource return preparation.

Step 5: Reconcile Local Rate Changes

State rates grab headlines, but local rates cause the most confusion. Cities, counties, and special districts impose their own levies on top of state rates. These local rates fund specific projects like transportation infrastructure, public safety initiatives, or community improvements. When projects end or new ones begin, rates change.

Washington’s Q1 2026 updates include dozens of local rate changes for law enforcement programs and lodging taxes. Arkansas reported numerous rate changes due to city annexations and boundary adjustments. Minnesota introduced multiple new lodging and transit levies effective January 1. Tracking these changes manually becomes impossible at scale.

Understanding Special District Levies

Special district taxes represent the frontier of sales tax complexity. Unlike city or county taxes that apply uniformly across a geographic area, special districts can overlap. A single address might fall within multiple districts, each with its own levy. One district funds transportation, another funds community development, a third funds tourism promotion.

These overlapping districts create calculation nightmares. ZIP codes no longer suffice for rate determination. You need rooftop-accurate geocoding to identify applicable districts. Even then, district boundaries change as voters approve or reject new levies. The same address that had a 7.5% total rate last year might have 8.25% this year due to newly approved district levies.

Furthermore, special districts often have unique rules. Some exempt certain product categories. Others apply only to specific transaction types. A tourism district might tax hotel stays but not restaurant meals. A transportation district might tax retail sales but exempt wholesale transactions. Understanding these nuances prevents over-collection and customer complaints.

Step 6: Document Everything for Audit Protection

Documentation separates successful audits from disaster audits. States can request records going back three to seven years depending on jurisdiction. During audits, the burden of proof falls on you, the business owner. You must demonstrate you collected, reported, and remitted tax correctly. Without documentation, auditors assess tax based on estimates, almost always in the state’s favor.

What documentation do you need? Sales records showing transaction details, locations, and tax collected. Exemption certificates for every tax-exempt sale. Registration confirmations for every state where you’re registered. Filed returns and remittance confirmations for every period. Product taxability research showing how you determined tax treatment. Nexus analyses demonstrating when you established economic presence.

Creating an Audit-Ready Record System

Audit readiness requires organization, not just collection. Throwing documents into folders doesn’t constitute a system. When auditors request specific information, you need to retrieve it within days, not weeks. A well-organized system saves time, reduces audit length, and demonstrates professional compliance practices.

Start with digital storage. Paper records deteriorate, get misplaced, and require physical space. Digital files remain accessible indefinitely, backup easily, and search quickly. Scan paper documents immediately and file them in organized folder structures by state, year, and document type.

Implement consistent naming conventions. Files named “tax return” tell you nothing. Files named “CA_2026_Q1_Return.pdf” immediately identify content. Create folder hierarchies that mirror your compliance structure: state, year, quarter, document type. This organization accelerates retrieval when auditors come calling.

Back up everything. Cloud storage with automatic backups prevents catastrophic data loss. Local storage fails when computers crash or natural disasters strike. Cloud services provide redundancy, version control, and accessibility from anywhere. Don’t cheap out on backup services; they’re insurance against compliance nightmares.

Finally, document your processes and decisions. When you determine a product’s taxability, write down your reasoning and source material. When you register in a new state, note why and when. This documentation proves good faith compliance efforts, which can reduce penalties if errors emerge. Auditors distinguish between intentional tax evasion and honest mistakes supported by research.

Conclusion: Taking Action on Your Year End Compliance

Year end compliance isn’t about checking boxes; it’s about protecting your business from expensive mistakes and audit headaches. The 2026 sales tax landscape presents challenges, but systematic preparation neutralizes most risks. Review your economic nexus obligations, audit exemption certificates, update taxability classifications, prepare for filing frequency changes, reconcile local rates, and document everything.

Remember, technology enables compliance but can’t replace human judgment. Automated systems miss nuances that experienced professionals catch. While software tracks thresholds and rates, it doesn’t understand your business model’s unique compliance risks. That’s where expert guidance becomes invaluable.

Don’t navigate year end compliance alone. My Sales Tax Firm specializes in helping businesses like yours master multi-state sales tax obligations. Our team stays current on every rate change, nexus rule, and compliance requirement so you don’t have to. Whether you need a comprehensive compliance review, help with specific state registrations, or ongoing support, we’re here to help. Contact My Sales Tax Firm today for a free consultation. Let’s ensure your 2026 starts with confident, compliant sales tax practices that protect your business and your peace of mind.